MultiBank Group Delivers Record H1 Results with $209M Revenue and MBG Token Driving 7X Returns Since Launch.

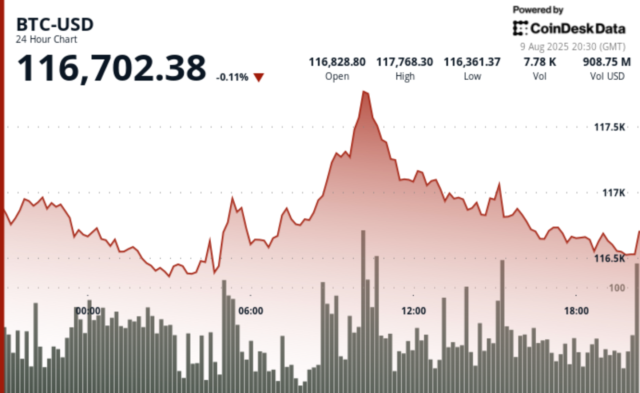

Crypto trading

[PRESS RELEASE – Dubai, United Arab Emirates, August 11th, 2025]

MultiBank Group, the world’s largest financial derivatives institution, has kicked off 2025 with $209 million in H1 revenue, up 20% compared to the previous year, and $170 million in profits. In April, the Group set a single-day trading record of $56 billion, with high client activity sustained across its global platforms.

Investor excitement peaked in July with the launch of the $MBG Utility Token on MultiBank.io, MEXC, Gate.io, and Uniswap. Since its debut on 22 July, $MBG has surged to roughly seven times its launch price, reflecting strong customer sentiment.

The $MBG token powers MultiBank’s four-pillar ecosystem:

- MultiBank FX/CFDs: Traders can use $MBG for fee discounts and enhanced platform access, while introducing brokers and social traders may benefit from token-based rebates and loyalty tiers.

- MEX Exchange (Institutional ECN): A hybrid FX and crypto ECN for emerging markets, where $MBG automates settlement, reduces counterparty risk, and enables smart contract-based margin and delivery versus payment (DvP).

- MultiBank.io (crypto exchange): Regulated in the UAE, Australia, and Seychelles, the platform offers spot and leveraged trading. $MBG is used for trading fee discounts, launchpad access, staking, and token buy-in events.

- MultiBank.io RWA: Built on Mavryk’s layer-1 blockchain, this arm follows a $3 billion real estate tokenization agreement with MAG Lifestyle Development. $MBG holders receive fee discounts, early project access, and benefit from revenue-linked token burns that gradually reduce circulating supply.

“Delivering $209M in revenue in just six months highlights the effectiveness of our core businesses and the trust our clients place in us worldwide,” said Naser Taher, Founder and Chairman of MultiBank Group. “The subsequent growth of our $MBG Utility Token shows how our digital asset program can build on that performance and create further value for stakeholders.”

With more than two million users, licenses from 17 regulators worldwide, and an unblemished compliance track record since 2005, MultiBank Group is scaling its blockchain and risk infrastructure to accelerate digital asset adoption and DeFi participation worldwide.

ABOUT MULTIBANK GROUP

MultiBank Group, established in California, USA in 2005, is a global leader in financial derivatives. With over 2 million clients in 100+ countries and a daily trading volume exceeding $35 billion, it offers a broad range of brokerage and asset management services. Renowned for innovative trading solutions, robust regulatory compliance, and exceptional customer service, the Group is regulated by 17+ top-tier financial authorities across five continents. Its award-winning platforms provide up to 500:1 leverage across Forex, Metals, Shares, Commodities, Indices, and Cryptocurrencies. MultiBank Group has received over 80 international awards for trading excellence and regulatory compliance.

For more information, visit MultiBank Group’s website.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!